(786) 363-0205Tap to Call This Lawyer

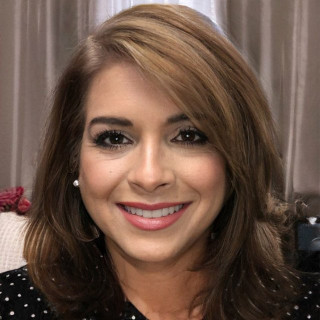

Ana Maria Del Valle-Aguilera

Knowledge. Experience. Foresight

Badges

Claimed Lawyer ProfileQ&AResponsive Law

Practice Area

- Business Law

- Business Contracts, Business Dissolution, Business Finance, Business Formation

Additional Practice Areas

- Contracts and Transactional Law

- Entity Formation and Corporate Governance

- Legal Risk and Compliance

- Corporate Training

- Financial Services and Payment Systems

Fees

- Credit Cards Accepted

Jurisdictions Admitted to Practice

- Florida

-

- Florida

- The Florida Bar

-

Languages

- English: Spoken, Written

- Spanish: Spoken, Written

Professional Experience

- Founder

- Corbus Law

- - Current

- Before founding Corbus Law, Ms. del Valle Aguilera spent more than thirty years representing companies and financial institutions in Miami, achieving strong transactional experience and knowledge of operational, compliance and risk issues surrounding corporations. Ms. Del Valle-Aguilera offers legal services to local and foreign organizations doing business in Florida, being a key business advisor to senior executives and management at client companies, providing business-focused and practical approach to problem solving. She uses her business experience to provide clients with proactive legal risk management, helping avoid problems before they arise. She concentrates on commercial contracts and other transactional agreements; company formation and corporate governance; employment matters such as hiring, termination, and employee handbooks; legal risk management; vendor management; policies and procedures; and, corporate training.

Professional Associations

- American Bar Association

- Current

-

- Dade County Bar Association

- Current

-

- Florida State Bar # 654418

- Member

- - Current

-

Legal Answers

63 Questions Answered

- Q. How can I claim a cashiers check that was lost? Sent to Ohio w/o my knowledge.I have a photo copy of the check/receipt.

- A: The facts are not too clear as you say that a check was sent to Ohio without your knowledge. Were you the purchaser of the check or was it made payable to you? Was the recipient in Ohio the payee on the check? You also state that you sent the documents/check to Ohio... where you in possession of the check?

Loosing a cashier's check is a common occurrence and every state has a statutory procedure that must be followed in order for you to make a claim if you are the purchaser or the payee on the cashier's check. Customarily the claim cannot be honored by the issuing bank within the first 90 days from the check's issuance date. This is so because the cashier's check is treated ... Read More

- Q. I owe Toyota corp $575.00 for repossing fee - what will happen?

- A: It depends on several factors. Have you paid your car loan in full and are you in possession of the car? Normally financing agreements provide that you are liable for all costs of repossession and sale. If the finance company is in possession of the vehicle they do not have to return it to you until you make all past due payments and pay the costs of repossession. You are responsible for repossession costs.

- Q. Am I following US or local law if I am a subcontractor working in the US, but I host data in Euro-based data centers?

- A: This is a complex area of the law and it isn't possible to provide a response with the limited information provided. You need to consult with a Privacy Professional or a Privacy Attorney that can review your process and provide you appropriate guidance depending on multiple factors. This would also include any written disclosures you may be required to make to your U.S. clients.

Social Media

Contact & Map