Free Consultation: (503) 443-1177Tap to Call This Lawyer

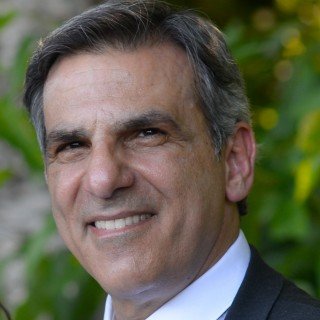

Vincent J. Bernabei

Vincent J. Bernabei LLC

Badges

Claimed Lawyer ProfileQ&A

Practice Areas

- Divorce

- Collaborative Law, Contested Divorce, Military Divorce, Property Division, Same Sex Divorce, Spousal Support & Alimony, Uncontested Divorce

- Personal Injury

- Animal & Dog Bites, Brain Injury, Car Accidents, Construction Accidents, Motorcycle Accidents, Premises Liability, Truck Accidents, Wrongful Death

- Estate Planning

- Guardianship & Conservatorship Estate Administration, Health Care Directives, Trusts, Wills

- Family Law

- Adoption, Child Custody, Child Support, Father's Rights, Guardianship & Conservatorship, Paternity, Prenups & Marital Agreements, Restraining Orders, Same Sex Family Law

- Probate

- Probate Administration, Probate Litigation, Will Contests

- Nursing Home Abuse

- Medical Malpractice

- Birth Injury, Medical Misdiagnosis, Pharmacy Errors, Surgical Errors

- Elder Law

- Domestic Violence

- Domestic Violence Restraining Orders, Victims Rights , Victims Rights

Additional Practice Area

- Car Accidents

Fees

-

Free Consultation

Free 15 minute initial telephone consultation - Credit Cards Accepted

-

Contingent Fees

Contingent fees in all injury and accident cases. -

Rates, Retainers and Additional Information

Competitive rates for high quality legal services. Often, fees may be shifted to opposing party.

Jurisdictions Admitted to Practice

- Oregon

-

- Washington

-

Languages

- English

Professional Experience

- Attorney

- Vincent J. Bernabei LLC

- - Current

- Attorney

- Kennedy King & Zimmer

- -

- Attorney

- Boettcher, LaLonde

- -

Education

- University of Nevada-Reno

- B.A.

- -

-

- Lewis & Clark Law School

- J.D.

- -

-

Awards

- Outstanding Volunteer

- Multnomah Bar Association

Professional Associations

- Washington State Bar # 14649

- Member

- - Current

-

- Oregon State Bar

- Member

- - Current

-

Websites & Blogs

- Website

- Website

Legal Answers

254 Questions Answered

- Q. How to update will and add husband to house title in Oregon?

- A: First, confirm that the deed to your home is in the name of your trust. If so, then you will need to amend your trust to add your husband as a trust beneficiary. If the deed to the home is not in the name of your trust, then you should transfer ownership to your trust, and then amend the trust to add your husband as a trust beneficiary. If the home is not in the name of your trust, then it will pass according to your will. Your question has some anomalies an estate planning attorney can specifically address after reviewing your trust and will.

- Q. Can my transitional alimony be taken away if I move in with someone? Oregon

- A: There are three kinds of spousal support in Oregon:

Transitional

Compensatory, and

Maintenance.

Transitional support helps pay for education or training so that a divorced spouse can find work, change careers, or advance in the job market. Transitional spousal support is usually of a short duration. When a judge decides if a spouse should pay transitional support, the judge considers:

The length of the marriage;

Each spouse’s financial needs and resources;

Each spouse’s job training, work experience, and employment skills;

Child-raising responsibilities;

Child support payments, and

Other relevant factors.

If there is a substantial and unanticipated change in either party's ... Read More

- Q. My mom's will had language that indicates that we don't need to do probate. Do we have to anyway?

- A: Probate is not always necessary. For example, if the deceased person owned bank accounts or property with another person, the surviving co-owner often will then own that property automatically. If a person dies leaving very few assets, such as personal belongings or household goods, these items can be distributed among the rightful beneficiaries without the supervision of the court.

If, however you are relying on the will to distribute assets of value, the will must be "proved" through the probate process. The deceased person’s will can be proved by an affidavit made under oath by the witnesses to the will. If such an affidavit is unavailable, the personal presence of the witnesses ... Read More

Social Media

Contact & Map