(805) 889-9281Tap to Call This Lawyer

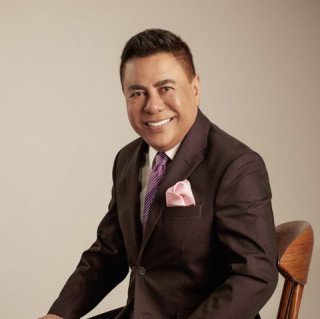

Rod B. Tuazon

Badges

Claimed Lawyer ProfileQ&A

Biography

Seasoned Professional and Entrepreneur with over 30 years of combined experience in Law; Real Estate, Leasing, Finance, Mortgage, and Property Management; Property/Casualty/Health/Life/Disability Insurance; Premium Audit; Worker's Compensation Underwriting and Risk Management; General Management; Financial Planning/Analysis; and Taxation.

Practice Areas

- Estate Planning

- Guardianship & Conservatorship Estate Administration, Health Care Directives, Trusts, Wills

- Real Estate Law

- Commercial Real Estate, Condominiums, Homeowners Association, Mortgages, Neighbor Disputes, Residential Real Estate

- Tax Law

- Business Taxes, Estate Tax Planning, Income Taxes, Payroll Taxes, Property Taxes, Sales Taxes, Tax Appeals, Tax Audits, Tax Planning

- Business Law

- Business Contracts, Business Dissolution, Business Finance, Business Formation, Business Litigation, Mergers & Acquisitions, Partnership & Shareholder Disputes

- Landlord Tenant

- Evictions, Housing Discrimination, Landlord Rights, Rent Control, Tenants' Rights

- Insurance Claims

- Bad Faith Insurance, Business Insurance, Disability Insurance, Health Insurance, Life Insurance, Motor Vehicle Insurance, Property Insurance

- Foreclosure Defense

- Probate

- Probate Administration, Probate Litigation, Will Contests

Languages

- English: Spoken, Written

- Tagalog: Spoken, Written

Education

- Washington University in St. Louis

- LL.M. (2021) | Taxation

- -

-

- The Colleges of Law

- J.D. (2019)

- -

-

- Regis University

- MBA | Business Administration

- -

-

Professional Associations

- State Bar of California # 338278

- Member

- Current

-

Websites & Blogs

Legal Answers

15 Questions Answered

- Q. I am in foreclosure but my bank will not accept the payoff.

- A: There are not enough facts in your question to provide you with a specific response. But assuming the property is in California and the foreclosure is non-judicial (trustee sale), which is common in the state, you have the right of redemption before a foreclosure sale. Your right to redeem ends when your property is foreclosed.

You also did not indicate the foreclosure date, but it’s best to take appropriate action early on when you have more options to work with, such as reinstating the loan, loan modification, repayment plan, forbearance, etc. In your case, payoff, which generally requires you to pay the remaining balance, including other fees and costs should be requested in advance as ... Read More

- Q. How can I find a lost insurance policy

- A: Assuming you are referring to a lost life insurance policy, the answer depends on whether you are the policy owner or a beneficiary of the life insurance policy.

If you are the policy owner and you know the insurance company and the policy number (or social security number), you may simply call the toll free number and ask for a “Statement of Insurance Coverage” or any similar term issued by the insurance company in lieu of a lost or misplaced policy. The statement shows the named insured, policy number, issue date, policy owner, death benefit amount, beneficiaries, and other pertinent policy information. I must warn you that the insurance company will generally communicate only with ... Read More

- Q. Can an HOA stop me from staying in the house I inherited from my mother who passed away?

- A: I believe the HOA may be correct. The Fair Housing Act exempts communities intended for people 55-62 or older to discriminate based on familial status. It appears that your mother’s trailer park caters only to residents who are over 60 years old. You have two options: either (1) find someone you can trust and is over 60 years old to be on title, which the HOA suggested OR (2) sell the property and move to a place where there are no restrictions.

Social Media

Contact & Map