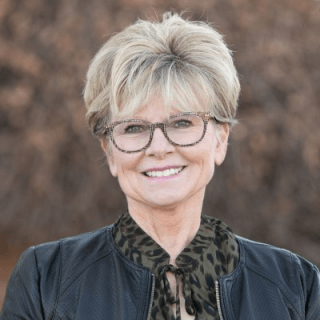

Marianne Blackwell

Caring and Expert Estate PlanningMarianne Blackwell focuses her practice on representing clients in tax planning, estate planning, and charitable gift planning. Prior to returning to the practice of law, Marianne worked in higher education fundraising for over 15 years and was a former senior director in the Offices of Gift Planning with the University of Colorado and Colorado State University. In those roles, she supported the fundraising efforts of these Universities and assisted donors and their advisors in considering and designing charitable giving plans as part of their personal financial and estate planning. Ms. Blackwell graduated from the University of Oklahoma in 1982 with a B.A. in psychology and received her Juris Doctorate from the University of Oklahoma College of Law in 1985. She practiced law in Oklahoma and Colorado in the areas of bankruptcy; civil litigation; wills, trusts, and probate; family law; contracts; and business formation and succession planning. Ms. Blackwell is a member of the Colorado Bar Association and a member of the Elder Law and Trust & Estate sections of the Colorado Bar Association. She also belongs to The Colorado Women’s Bar Association, and the Larimer County Estate and Trust group and supports the Women’s Foundation in Denver as well as animal care and advocacy organizations. She has presented at conferences and hosted webinars on estate planning, empowering women in estate and financial planning, gift-planning operations, and fundraising.

- Estate Planning

- Guardianship & Conservatorship Estate Administration, Health Care Directives, Trusts, Wills

- Elder Law

- Probate

- Probate Administration

- Business Succession Planning

- Charitable Planning

- Non-profit Law and Support

-

Free Consultation

Let's talk for a few minutes so you can learn how my law firm serves its clients differently from other estate planning firms and if we are a good match together! https://calendly.com/blackwell-law/30min - Credit Cards Accepted

-

Rates, Retainers and Additional Information

Easy and flexible payment options.

- Colorado

- Colorado Supreme Court

- ID Number: 21575

-

- University of Oklahoma College of Law

- J.D. (1985) | Law

- -

-

- State Bar of Colorado # 21575

- Member

- Current

-

- Ch. 31 Philanthropy and Planned Giving

- Colorado Bar Association Senior Law Handbook

- Chapter 19 Simplify Your Life: How to Manage Your Estate and Life -- and Benefit You and Your Heirs

- Colorado Bar Association Senior Law Handbook

- Chapter 29: Estate and Succession Planning for Farmers and Ranchers

- Colorado Bar Association Senior Law Handbook

- Website

- Website: Blackwell Law PLLC

- Q. If I am the next of Kin and there is not a Will in place, what are the next steps?

- A: Hello ~ if a person dies in Colorado and there is no will found, that decedent will have died 'intestate'. An heir or interested person can still file for probate, but it will be with the distinction that there is no will under which to follow the distribution of estate assets. Instead, there are Colorado laws that provide the hierarchy for the distribution of estate assets to heirs. For example, if an unmarried person without children passes without a will, the decedent's parents will inherit, if they are living. If the same decedent has a surviving spouse and biological children, those family members will inherit.

It is entirely possible that no probate proceeding is necessary, ... Read More