Free Consultation: (801) 210-1058Tap to Call This Lawyer

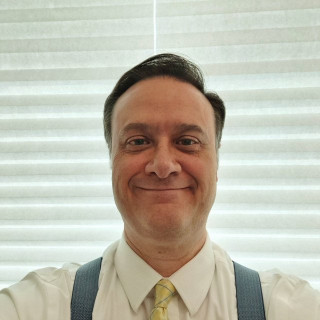

Kenneth Prigmore

Prigmore Law, PLLC

Badges

Claimed Lawyer ProfileQ&A

Biography

Ken Prigmore owns Prigmore Law and has been licensed in Utah since 2006. His focus is on Wills, Trusts and Probates. Ken is careful to give his clients pressure-free options and advice.

When he isn't at work, you can usually find him spending time with his family. Their favorite local vacation spot is St. George, Utah.

Practice Area

- Estate Planning

- Guardianship & Conservatorship Estate Administration, Health Care Directives, Trusts, Wills

Fees

- Free Consultation

- Credit Cards Accepted

- Contingent Fees

Jurisdictions Admitted to Practice

- Utah

-

Professional Experience

- Solo Attorney

- Prigmore Law, PLLC

- - Current

- Solo Attorney

- Wasatch Disability Law, PLLC

- -

- Representing clients seeking Social Security Disability benefits.

- Managing Attorney

- Utah Disability Law

- -

- Practicing Social Security Disability law.

- Associate Attorney

- Jeffs & Jeffs, P.C.

- -

- Representing clients in Social Security claims, drafting estate planning documents, creating corporations, drafting contracts, researching real estate issues.

- Associate Attorney

- Reneer and Associates

- -

- Drafting motions and representing clients at hearings and at trial.

- Clerk / Associate Attorney

- Hughes and Morley

- -

- Meeting with clients. Drafting contracts. Representing clients at hearings.

Education

- University of Oklahoma College of Law

- J.D. (2006) | Law

- -

- Honors: Dean's List

-

- Brigham Young University

- B.A. | English

- -

-

Professional Associations

- Utah State Bar # 11232

- Member

- Current

-

- Utah Association for Justice

- Member

- -

-

- Utah Association for Justice

- President of the Social Security Law Section

- -

-

- Wasatch Front American Inn of Court

- President

- -

-

Publications

Articles & Publications

- "Should My Client Apply for Social Security Disability?"

- Utah Trial Journal

Websites & Blogs

- Website

- Prigmore Law

Legal Answers

186 Questions Answered

- Q. Can I amend my revocable trust myself or need an attorney?

- A: Great question. Amending your trust on your own carries similar risks to creating your trust on your own. Let's say you get the wording right, and your amendment looks perfect, and you sign it in front of a notary. The lingering question will be what effect did that change have? Is there anything unexpected or undesired happening as well?

Further, you want to meet with an attorney every 5-10 years to discuss life changes and how those changes can be addressed in your estate plan. Keep in mind that the law changes regularly and what you intended to do originally isn't going to work today. Discussing your plans with an attorney will help you avoid the degradation that time can cause. ... Read More

- Q. How to access sister's account at CalCoast after her passing?

- A: I am sorry to hear about your difficulty with the bank! You can always retain an attorney in California that can represent you at the bank. You can also sue the bank in California. In the Petition you would request that the Court force the bank to honor your court appointment as executor.

On occasion, I see where someone has been named as the executor in the will, but they did not probate the will, so there is no official court appointment. The court appointment is what will force the bank to give you the money. Sometimes banks in other states don't do well with documents from a differing state.

In Utah, you can give a bank a Small Estate Affidavit, stating that you are collecting ... Read More

- Q. Mom died, no will, I am the beneficiary her bank account. A cashiers check for over $100K, she is both payee and payor.

- A: Though your facts don't specify a question, it is likely you have discovered that you can't cash the check. Sometimes a "Small Estate Affidavit" can be used to collect funds when someone has died. The limit in Utah on using this type of affidavit is $100,000.

As you have funds that exceed that amount, you will need to go through some form of probate to get the authority to withdraw and distribute the funds.

Few people have the patience to learn Probate law and handle the process on their own. It's complicated enough we can't teach you how to do it here. I have helped clients that attempted to do it on their own and failed. This adds time, and sometimes unnecessary ... Read More

Social Media

Contact & Map